A higher SOFR rate is pressuring equity markets.

Watch Dollar, SOFR, 10Y UST and oil.

"Published by GMG Research

- New highs on the SOFR yield is what pressured markets last week.

- Nasdaq was way too overbought. Over 90% of stocks in the index were above their 50d moving average.

- Bitcoin ETF is about to get approved. We have come a loooooong way.

- Fed official says they should slow Treasury runoff as overnight reverse repo balances approach 'a low level.'

- Watch SOFR yields still for market direction

- AMD is still super strong

NDX: One of the best overbought indicators

Increasing volume and new highs on SOFR yield is what pressured markets last week.

VIX vs High Yield Spread is an indicator to use during systemic risk.

GS’s conviction list.

AMD still has legs.

Two weeks ago we wrote: 'Sudden spike In SOFR warns that maybe QT will stop sooner than expected.'

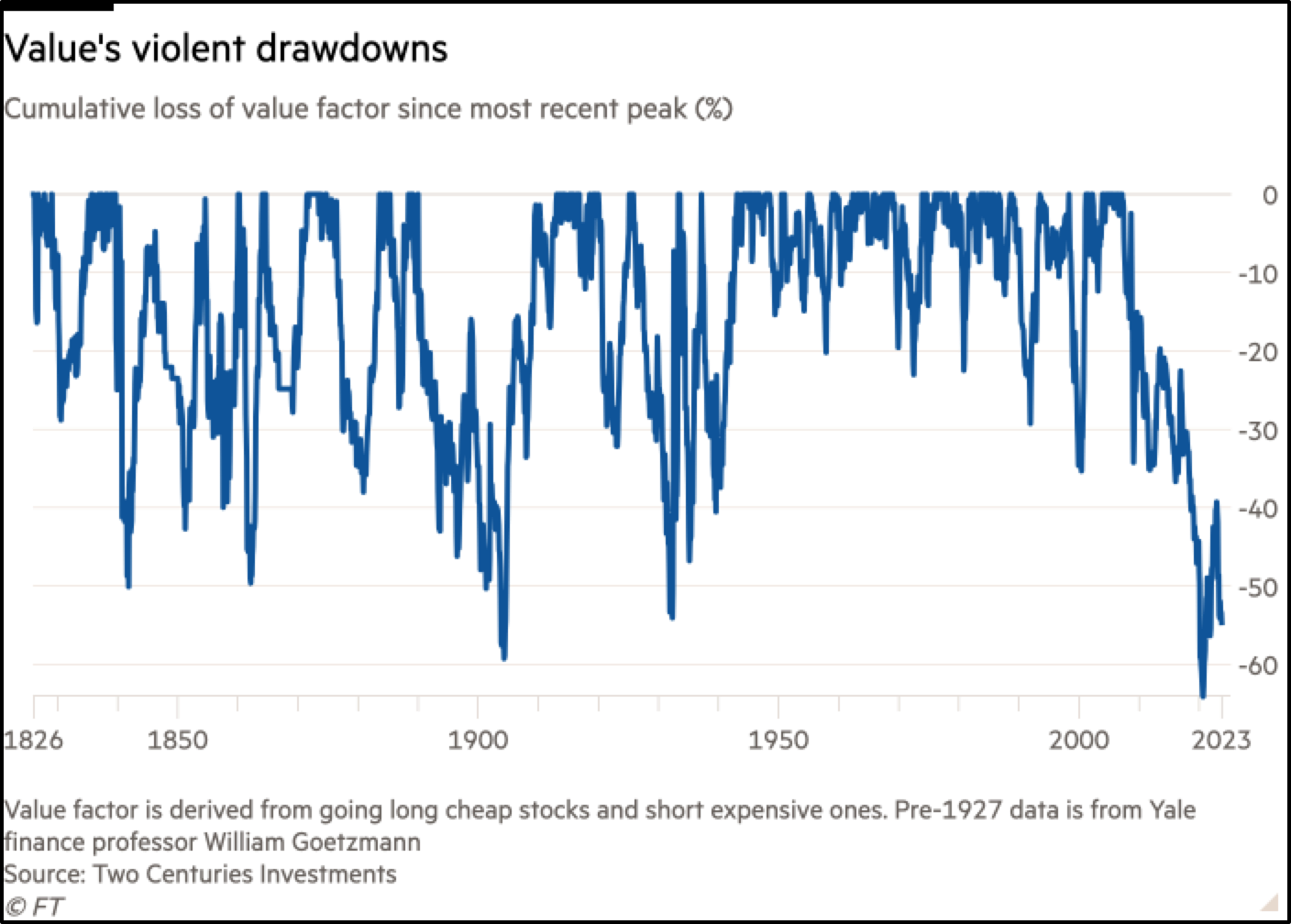

Value is always tough. Rather own Quality factor instead.

Factors are getting sizeable allocations (QUAL MTUM VLUE SIZE)

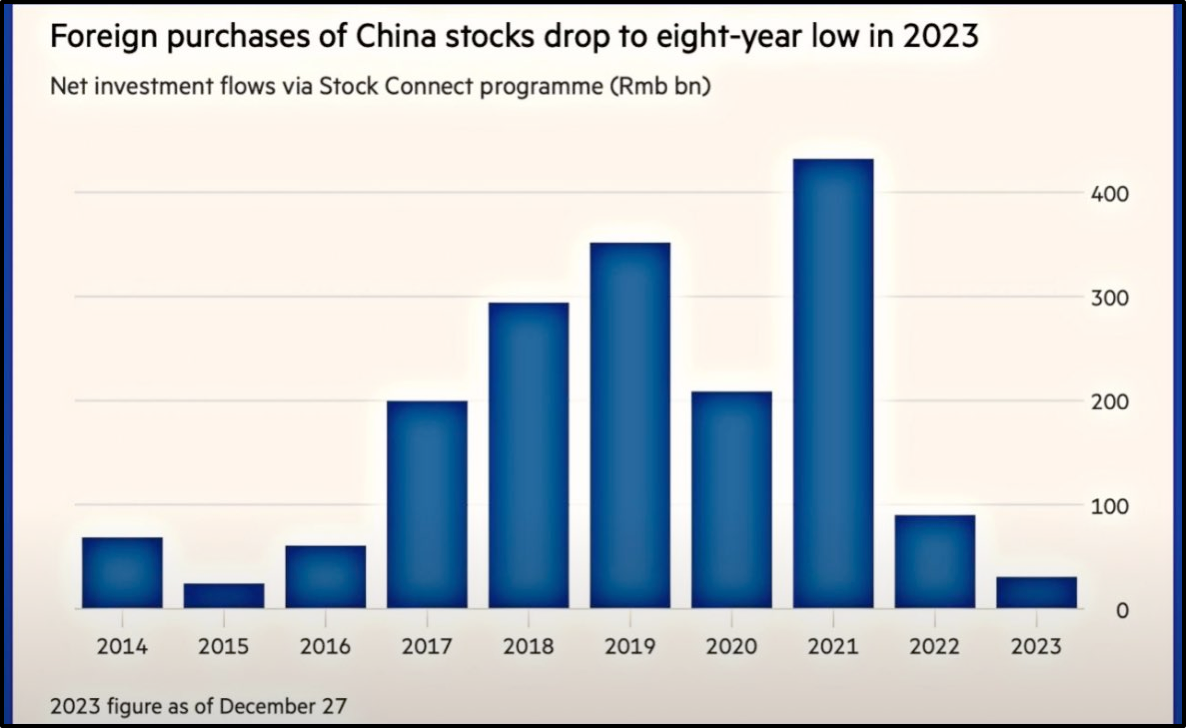

China is still getting no love.

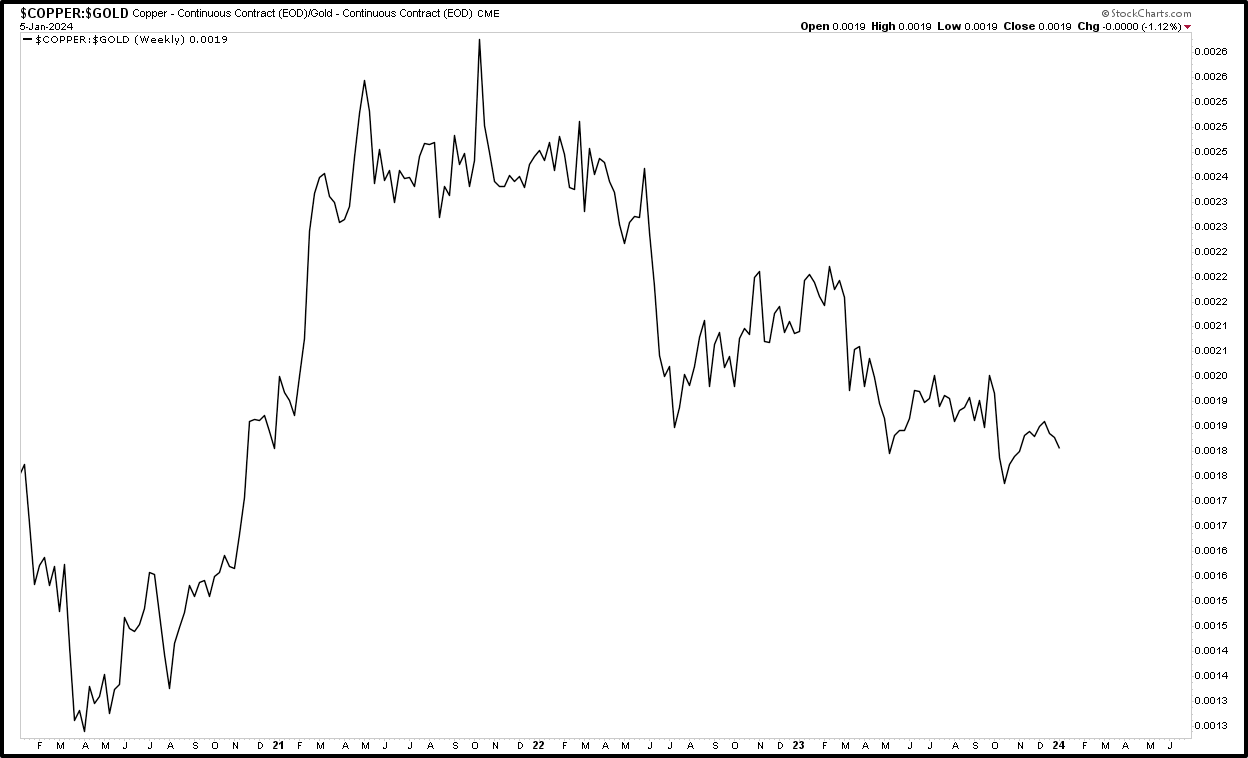

Copper (economic activity) is weak vs Gold

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors."

![#GMGResearch Via #ZeroHedge: A Higher #SOFR Rate [Secured Overnight Financing Rate] Is Pressuring Equity Markets. "Increasing Volume And New Highs On SOFR Yield Is What Pressured Markets Last Week."](/content/images/size/w800/2024/01/60c11a8e-7721-4e38-a462-61cc723fc170_1144x1088.webp)