From the article: "Rana Foroohar, FT [excerpt]: A few weeks ago, in the run-up to the US-#China Apec summit, I warned Swampians not to get too optimistic about any fundamental shift in the relations between the two countries. I take no pleasure in saying I think I’m being proven right.

Sure, big #business and multinational CEOs would love to pretend that we could time warp back to the 1990s, but it’s not happening, as seen by Wall Street pulling back #money from China, and Moody’s telling staff in the country to work from home before lowering the country’s credit outlook last week. The very legitimate fear was that #employees might be subject to investigation, police raids or worse for delivering bad #news. Who wants to do business in a country in which executives have to worry about being 'invited to tea', as the euphemism goes, if they step wrong?

As I’ve already written, business leaders should be asking themselves the same thing about the US should Donald Trump be re-elected. But that’s a topic for another day[...]. To get back to China, and why the world is falling out of love with #investing there, we need to look at how the big picture grievances of excessive Chinese #trade surpluses, cheap product #dumping, and shaky #ruleoflaw are not going away, but rather getting worse. And this isn’t just about the US-China relationship, but also the US and #Europe.

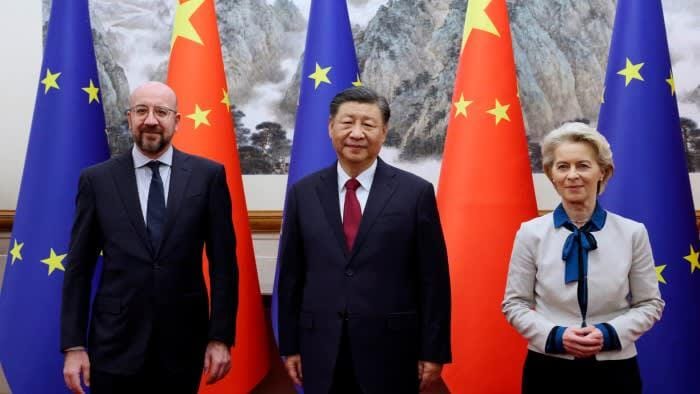

Late last week, #EuropeanCommission President Ursula von der Leyen met Chinese President #XiJinping to discuss growing #EU concerns about the growing trade deficit with China, which she said was down to 'well known' causes like lack of fair market access in strategic sectors, preferential treatment for Chinese companies and overcapacity in the country’s manufacturing, which is resulting in the dumping of clean tech such as #electricvehicles and lithium #batteries on to world markets.

Chinese officials claim that the trade deficit with the EU, which has doubled in the past two years, is going to get better soon, but I’m not sure how. China isn’t cutting state #investment money but is rather shifting stimulus money away from housing and into manufacturing. As Peking University professor Michael Pettis has written, that maths doesn’t work when other regions like the EU and the US want to produce more locally (as I think they rightly should as part of geographic de-risking — need we go over again the risks of producing critical strategic goods in just one small part of the world?).

In the past, the US and the EU simply would have hoovered up cheap Chinese stuff, and let jobs and investment dollars go elsewhere. That’s no longer a political possibility. So, I think we will see greater trade and investment strife between not only the US and China, but also Europe and China, in the near future. I suspect that such problems will start with clean tech, but I suspect that the car industry may quickly become ensnared in a bigger trade conflict in the coming year."

#news #business