"[With today being Black Friday,] retailers are offering larger discounts in advance to lure inflation-weary shoppers back to their stores. According to an Adobe Analytics analysis, retailers got a headstart on Black Friday deals this year, with most online product categories offering extended holiday discounts beginning in October.

Online apparel prices were down 9% during the month, compared to 2% and 5% discounts in 2021 and 2022, respectively.

Furniture discounts were 5% this October, compared to 2% and 1% in the previous two years. Steeper discounts were also reported for sporting goods, televisions, and appliances.

Adobe Analytics tracks eight online product categories and said only electronics and toys had fewer discounts than the previous holiday seasons.

Separate data from Jane Hali & Associates, a retail-focused research firm, shows that major brands like Kohl’s and Macy’s have already slashed prices by up to 60% on some products.

Research from GlobalData backs up these numbers. The analytics firm said 8% of items sold in October were discounted, compared to 7% in 2022 and 3% in 2021.

In all, the average discount rose to 24%, up from 13% in 2021 and 20% in 2022.

While it’s not unusual for Black Friday deals to begin earlier than the day after Thanksgiving, retailers are working extra hard this year to push their products out the door because of slower consumer spending.

Consumer spending weakens ahead of holidays

Experts warn that consumers are already tapped out and don’t have enough money to splurge this holiday season.

In the latest quarterly reports, several major retailers, including Walmart and Target, have raised concerns that this season may be slower than usual.

'Consumers are feeling the weight of multiple economic pressures, and discretionary retail has borne the brunt of this weight,' said Christina Hennington, Target’s chief growth officer.

'We are more cautious on the consumer than we were 90 days ago at this time,' said Walmart CFO John David Rainey.

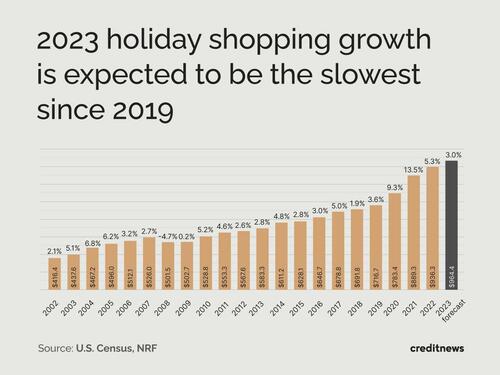

According to the NRF, holiday sales in November and December are forecast to rise between 3% and 4% compared to the same period in 2022, the smallest increase in five years.

That’s a problem for the retail sector, which derives 19% of its annual revenue from the holiday shopping season."