(Right Click on Article's Hyperlink Above to Open Chart in a New Tab...)

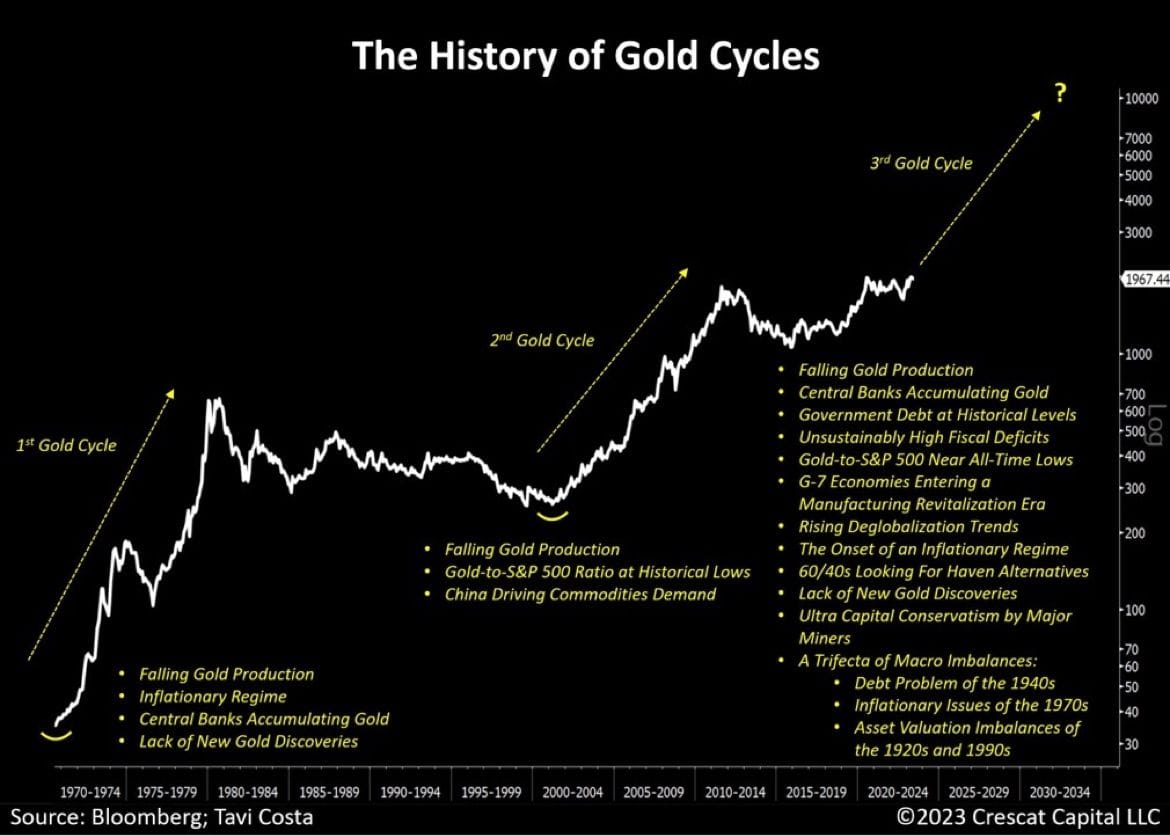

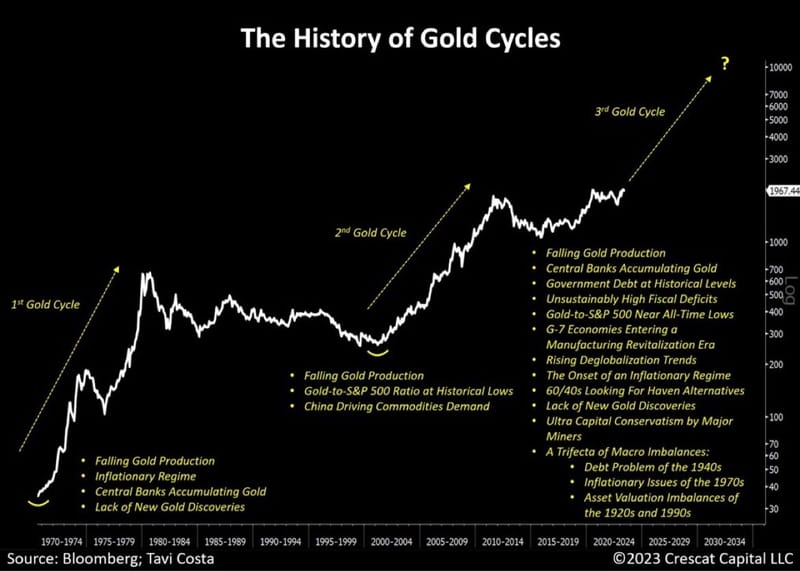

"Today is undeniably a pivotal moment for the precious metals industry.

A monthly close at an all-time high would likely mark the beginning of another secular move in gold.

This is yet to be propelled by two primary buyers:

▪️Central banks, which, even with their recent purchases, still own 80% of sovereign debt relative to their balance sheet assets

▪️ Traditional 60/40 portfolios, currently with 0% allocation to gold, are yet to redefine their mandates to incorporate the metal as another defensive alternative.

This is an opportune moment to actively seek ways to express this view in the market.

Other precious metals like silver and the mining industry remain highly distressed and are likely to emerge as the largest beneficiaries of this long-term trend."