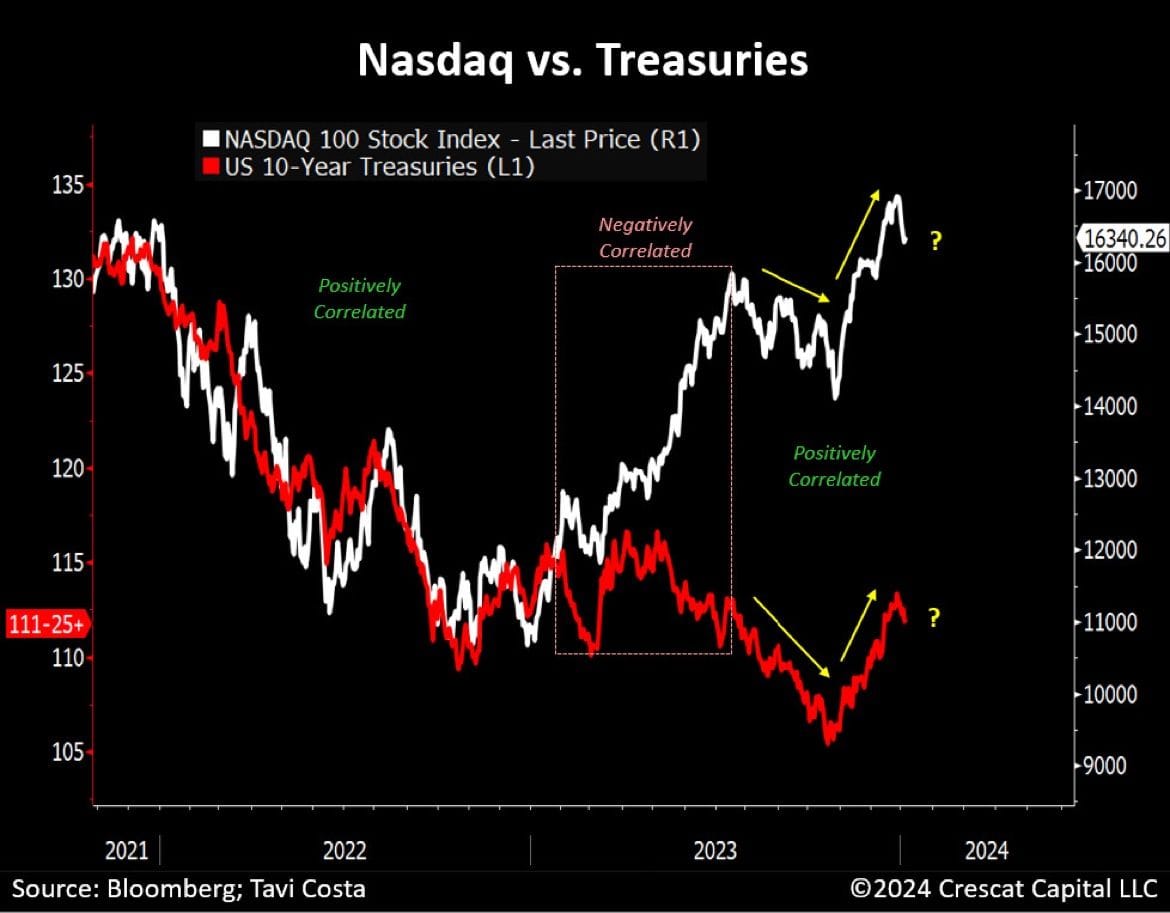

"This has largely gone unnoticed, but Treasuries and Nasdaq stocks are now back to being positively correlated since mid-2023.

That's exactly what we experienced in 2022 when fixed-income instruments severely declined in tandem with US equities.

It is important to note that during a brief period around the ChatGPT release and the AI craze, these two markets moved in opposite directions for approximately 6 months.

As inflation potentially re-emerges and the government continues to grapple with a severe deficit funding problem, there is a likelihood of upward pressure on long-term yields, potentially impacting US stocks this year.

Let's not overlook the fact that an unprecedented $8.2 trillion of outstanding Treasuries will need to be re-issued in the next 12 months."

![#OtavioTaviCosta Of #Crescat Capital: "[As Inflation Potentially Re-Emerges And The Gov't Continues To Grapple W/a Severe Deficit Funding Problem, There Is A Likelihood Of Upward Pressure On Long-Term Ylds, Potentially Impacting US Stocks Negatively...]"](/content/images/size/w800/2024/01/1705521286176-2.jpg)