Otavio (Tavi) Costa on LinkedIn: This is probably one of the most important charts I’ve seen in the last… | 23 comments

This is probably one of the most important charts I’ve seen in the last weeks. Commodities are the most underweight relative to bonds since March 2009. It… | 23 comments on LinkedIn

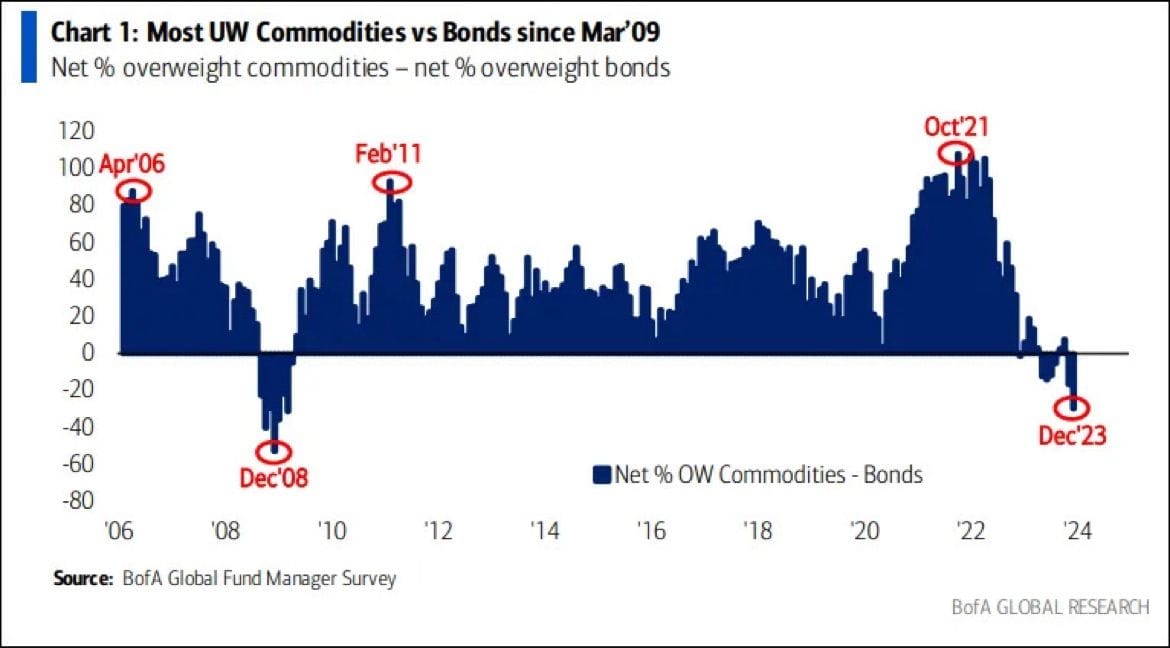

"This is probably one of the most important charts I’ve seen in the last weeks.

Commodities are the most underweight relative to bonds since March 2009.

It underscores the historical extremity in the valuation disparity between hard vs. financial assets.

The shift back to resource industries may catch many investors off guard as valuations in crowded sectors compress.

It's worth noting that three out of the last four commodity cycles in the past 130 years coincided with inflationary periods.

Against the backdrop of deglobalization, extensive fiscal spending, and labor cost pressures, a broad increase in commodity prices would only add fuel to the inflation fire.

H/t to Ronald Peter Stoeferle, CMT, CFTe, MSTA for pointing this out first"