"RETAIL BEING FLEECED BY ONLINE BROKERS: MORE EVIDENCE

A few days after my last post on this issue (below), another paper was published again showing retail investors are being taken to the cleaners by sleazy online brokers.

Conclusions from 'Betting on Elusive Returns: Retail Trading in Complex Options':

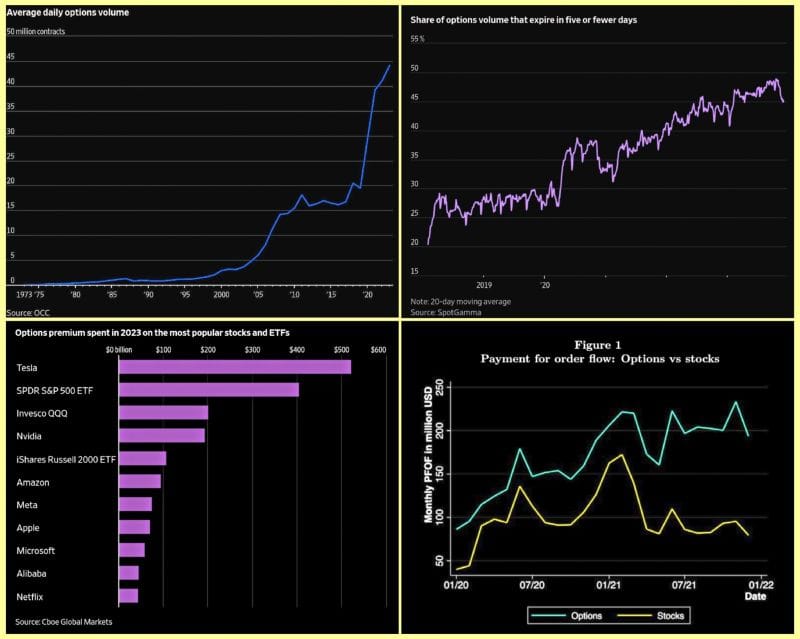

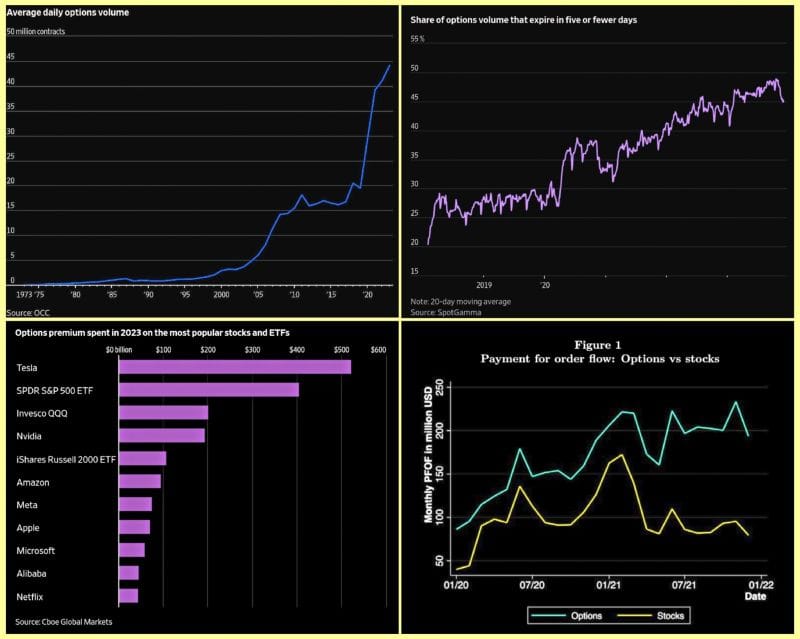

- Retail trading in multi-leg complex options has surged with commission-free trading.

- Trades typically yield negative returns of 16.4% over three days, and even lower returns with an increase in complexity.

- Attracted by low prices, high volatility, embedded leverage, and lottery-like features, retail investors often misperceive the risks, opting for riskier strategies that underperform.

Robinhood, E-Trade, and presumably many others are encouraging option trading by 'gamifying' the placement of complex option strategies which will on average harm their customers but benefit the brokers.

Robin Hood was said to steal from the rich and give to the poor. The opposite seems closer to the truth for the company that took his name."

"GAMBLING, AMERICA'S NEW NATIONAL PASTIME

Options trading volume by retail investors has exploded. Wall Street is the winner.

Now that gambling on sports has been de facto legalized in the US, it's not surprising that many ordinary Americans now view Wall Street as just another place to speculate and options are their favorite game. And just like at the Belagio or Caesars, there's lots of friendly brokers happy to take your bets, ply you with free drinks, and keep you trading until you're broke.

There's a reason people don't go to Las Vegas to invest their retirement savings. The only consistent winner at a casino is the bank. And so it is with options where the "bank" is Wall Street. If you're in a card game and you don't know who the dupe is, it's you.

Two recent academic papers evaluated retail participation in option markets here https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4065019 and here https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4050165. The major conclusions were:

- About half of all options trading is done by retail investors

- Retail are usually speculators:

-buy twice as many calls as puts,

-buy short dated contracts

-buy calls on volatile high profile single stocks

- Bid-ask spreads are 10 to 12%

- Between Nov 2019 and June 2021, retail collectively lost $2.1bn on options

- Retail lose 5-14% per trade on average

- Retail brokers earned $2 billion on payment for order flow (PFOF) in 2022

Speaking of con artists...

[WSJ] Tom Sosnoff, co-founder of the retail brokerage Tastytrade, says people are looking to get the most bang for their buck. In the Robinhood example, each contract gave the trader the right to buy 100 shares of stock, offering a relatively cheaper way to play the moves in the shares.

See the pitch? 'More bang for the buck' sounds like a good deal but it's just another way of saying 20x leverage. 'Cheaper way to play stocks' is another con artist way to describe leverage. Using options to invest in stocks is hugely expensive, complex, and risky. But if you must buy options, at least find a firm that doesn't sound like a snack food.

[WSJ] Sosnoff says he expects a zeal for betting on things such as sports to lead to even more interest. He tours the country hosting live trading events for individuals and says he plans to lead more events than ever next year to match the interest. 'Everybody’s betting on everything,' Sosnoff said. https://www.wsj.com/finance/stocks/the-adrenaline-fueled-trades-sweeping-the-market-b66204fa?mod=hp_lead_pos3

We know what Tom is betting on -- a fresh supply of dupes in every city.

The vast majority of individual investors should "just say no" to buying options. You'll have more fun in Vegas and probably lose a lot less money."