(Written by Bert Dohmen, contains excerpts from our latest December 2, 2023 Wellington Letter issue)

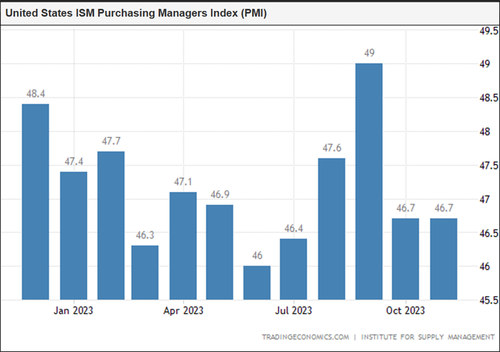

"Last week’s ISM Purchasing Managers Index (PMI) report for November showed no change from the previous month, remaining at 46.7. Remember, anything below 50 means a 'contraction' in manufacturing, which suggests the economy is slowing.

This marks the 13th consecutive month the ISM has come in below 50, which is the longest period in contraction territory since August 2000 to July 2022. For those in the 'no recession' camp, we would point to this indicator as just one that indicates we’re already in a recession. See the chart below (chart via tradingeconomics.com):

Furthermore, the Conference Board LEI (leading economic indicators) have been negative for 19 months.

For the 18th straight month, the Dallas Fed's 'general business activity and company outlook indexes' have been negative (indicating contraction), dropping to 4-month lows at -19.9 in November.

'Continuing Unemployment Claims' have now gone to another new high this year. That shows that the alleged 'tight' labor market is a fairy tale. There is just a shortage of qualified people.

While the majority of analysts are talking about a 'robust economy,' 'no recession in sight,' and 'a soft landing,' we say that the global economies, including the US, are in recessions. Over the past 48 years we have seen most pre-recession periods like this.

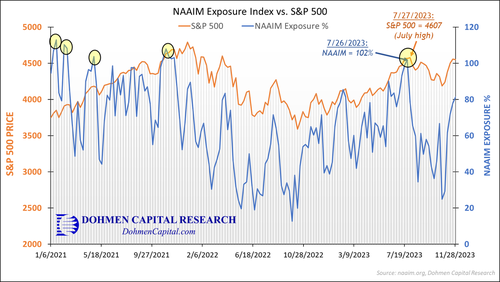

CURRENT SENTIMENT: The NAAIM Exposure Index (National Association of Active Investment Managers) is another good gauge of sentiment right now.

On July 26th of this year, active investment managers had 102% equity exposure, which we revealed in our July 30thWellington Letter titled “The Last Hurrah?” We explained that this high level of equity exposure (over 100% is leveraged) is what’s seen 'at or approaching tops, not at or during buying opportunities.'

Sure enough, that marked the peak for the major indices and the market plunge started within 1-5 days (depending on the index).

The latest reading shows 81.3% equity exposure among these managers, its 6th consecutive week higher. This shows the bullishness is not quite yet 'extreme' and therefore, combined with our technical analysis on the charts above, suggests the market rally should last a bit longer.

On the chart below we compare the NAAIM Exposure % (blue line) to the S&P 500 (orange line). Notice how the NAAIM tends to be a good leading indicator before pullbacks and bigger corrections in the S&P 500.

The yellow shaded areas indicate times the NAAIM Exposure was over 100%, with the most recent occurrence on July of this year, just before the 11% drop in the S&P 500 (although the broader indices suffered 16%-18% plunges).

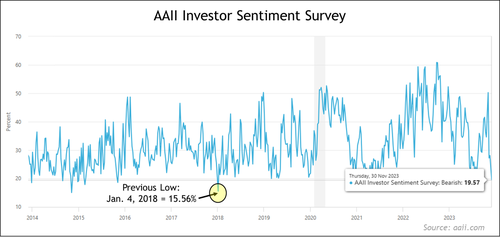

We now see bearish sentiment at its lowest level in 6 years according to the latest AAII data (individual investors sentiment survey). See the chart of '% Bearish' below, which is currently under 20% (chart via macromico.com):

CONCLUSION: The bulls are getting giddy with enthusiasm. It is reminiscent of other strong bear market rallies over the past 50 years leading up to important tops.

While sentiment is by no means an exact timing indicator, it shows how quickly the overall bearishness subsided over the past few weeks. The bearish thing about this is that such periods of 'low bearishness' are followed by meaningful declines.

In fact, the start of my firm in January 1977 was partly because the percentage of bearish advisors hit an all-time low below 4%. That means everyone was bullish. I was so certain that it was a market top and a bear market was ahead, that I wanted to put it in writing for posterity.

That is how our Wellington Letter was born, in January 1977. We sent it to major financial media. The Wall Street Journal picked it up. The journalist for the "Heard On the Street" column, Gene Marcial, couldn’t find another bear. Fortunately for me, the bear market started soon thereafter. That made our business successful right from the start.

The rest is history. Years later I met him in person and said, 'thank you!'

Find out what our research reveals about the best way to safeguard your wealth now in our latest award-winning Wellington Letter.

If you enjoy reading research and insights like this, we encourage you to take advantage of our Cyber Week Special Offers on all of our top-rated research services for a limited time. Click this link to save up to 50% now and gain instant access today! (*Cyber Week Savings End Tonight, December 3rd, at 11:59 PM PST)

We hope to welcome you as a valued member soon,

Bert Dohmen

Founder, Dohmen Capital Research"